Evaluating the Benefits of Tiny Homes Buying as an Investment

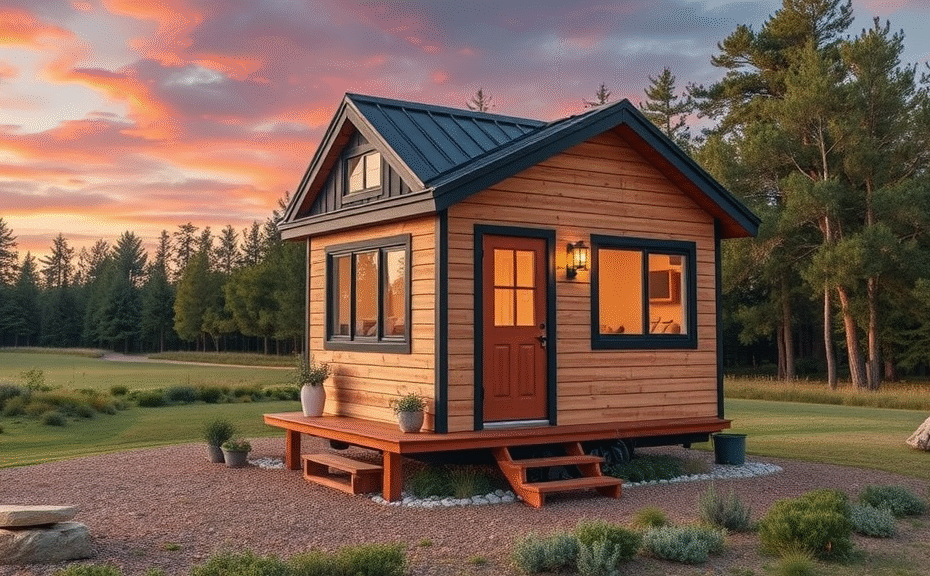

Investing in tiny homes buying has become increasingly popular as people seek affordable, sustainable living options. Tiny homes typically require less upfront capital compared to traditional real estate, making them an attractive investment for those looking to enter the property market with a lower financial commitment. These compact dwellings appeal to minimalists, travelers, and environmentally conscious buyers, creating a niche demand that could offer promising returns.

Market Demand and Rental Potential

The growing trend toward downsizing and simpler lifestyles fuels demand for tiny homes, especially in urban and vacation markets. Investors can capitalize on this by purchasing tiny homes and renting them out as short-term vacation rentals or long-term affordable housing options. This versatility enhances cash flow opportunities. Additionally, tiny homes can be placed on unused land or leased lots, increasing their rental appeal without the high costs of traditional property investments.

Considerations for Long-Term Value

Despite their advantages, potential investors should consider zoning laws, building codes, and community regulations that may restrict tiny homes buying in certain regions. Resale value can also vary widely depending on location and market acceptance. However, with rising interest in eco-friendly and minimalist living, the long-term appreciation potential of tiny homes is promising, especially in areas supporting sustainable development.

Key Advantages at a Glance

- Lower initial investment compared to traditional homes

- High demand in niche markets such as vacation rentals

- Flexible placement options, including land leasing

- Appeal to environmentally conscious and minimalist buyers

- Potential for strong rental income and passive cash flow

Investing in tiny homes buying offers a unique opportunity to diversify your portfolio with affordable, versatile properties aligned with modern lifestyle trends. Proper research and strategic location selection remain critical to maximize returns in this emerging market.