Evaluating the Financial Potential of Tiny Houses

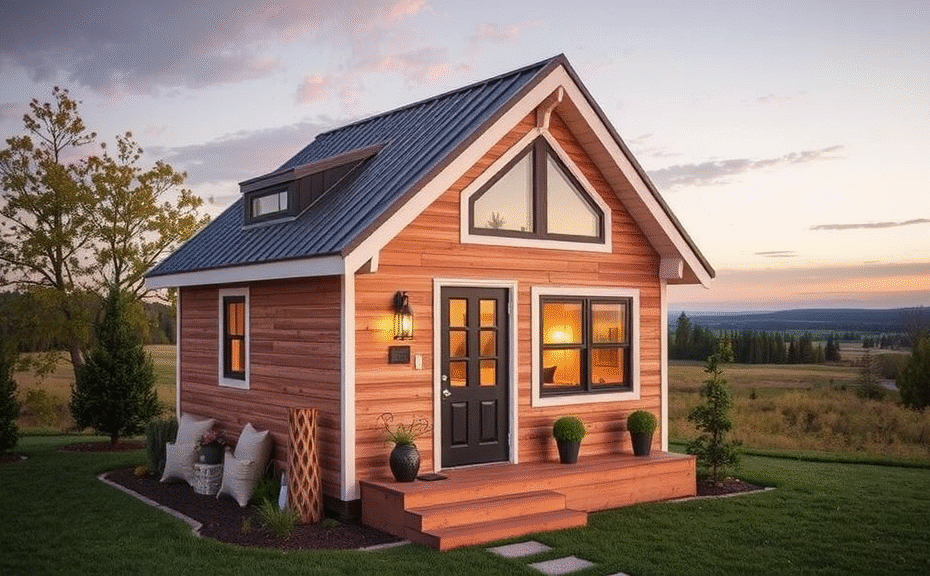

Tiny houses have gained significant popularity as an alternative housing option, raising the question: are tiny houses good investments? From a financial standpoint, these compact homes offer a unique set of benefits and challenges that influence their investment value. Their affordability compared to traditional homes makes them attractive, especially in high-cost housing markets. Lower construction and maintenance costs can lead to quicker returns on investment, particularly when used as rental properties or vacation homes.

Factors Affecting Investment Value

The investment potential of tiny houses depends heavily on location, zoning laws, and market demand. In urban areas with limited housing availability, tiny homes can provide affordable living alternatives, increasing their appeal to renters and buyers alike. However, strict zoning regulations or community restrictions may limit where tiny houses can be placed, impacting their resell value and usability. Investors must research these local factors meticulously before committing funds.

Benefits Beyond Monetary Returns

Beyond pure financial metrics, tiny houses encourage minimalist living and sustainability, aspects highly valued by certain buyer demographics. This lifestyle appeal often translates into strong niche market demand, which can boost long-term investment performance. Additionally, the mobility of some tiny homes enhances flexibility, allowing owners to relocate or adapt to market changes more readily than with traditional real estate.

Key Considerations for Potential Investors

- Understand zoning and legal restrictions in target areas

- Analyze local demand for affordable, small-footprint housing

- Calculate total costs including land, utilities, and permits

- Consider usage options: rental income, personal use, or resale

In conclusion, tiny houses can be good investments when chosen thoughtfully, balancing cost-efficiency with market compatibility. Their niche appeal, combined with lower upfront costs, makes them a promising option for many looking to diversify their real estate portfolio.