The Investment Potential of Tiny Houses

Tiny houses have gained significant attention as an alternative living solution, but when considering if tiny houses are good investments, several factors come into play. The appeal lies in their affordability, mobility, and sustainability, making them attractive to a niche market interested in minimalist lifestyles and eco-friendly living. However, the investment value depends heavily on location, construction quality, and local real estate regulations.

Financial Benefits and Considerations

One of the main reasons tiny houses attract investors is the low initial cost compared to traditional homes. This lower entry price can make it easier for first-time buyers or landlords looking to diversify their portfolio. Additionally, tiny houses often incur lower utility and maintenance costs, boosting overall return on investment. Yet, resale value can be unpredictable since tiny homes do not always appreciate like conventional properties.

Key Factors Impacting Investment ROI:

- Location: Proximity to urban centers and legal zoning is critical.

- Market Demand: Tiny homes must appeal to renters or buyers seeking compact living.

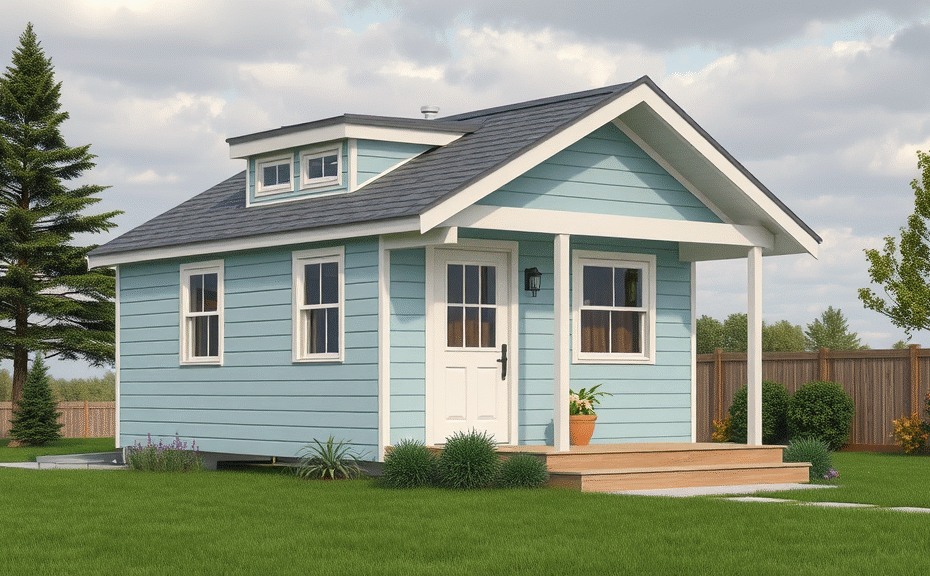

- Customization and Quality: Well-built, energy-efficient tiny houses fetch better prices.

- Regulatory Environment: Compliance with local codes affects ease of sale and use.

Long-Term Viability

Investing in tiny houses can be financially rewarding if aligned with market trends supporting affordable and sustainable living. They work well as vacation rentals, guest houses, or even personal retreats that generate income through platforms catering to unique lodging experiences. To maximize investment potential, one should conduct thorough market research and focus on strategic placement and durable designs.